How will the 2025 inflation adjustment numbers affect your year-end tax planning?

The IRS has issued its 2025 inflation adjustment numbers for more than 60 tax provisions in Revenue Procedure 2024-40. Inflation has moderated somewhat this year over last, so many amounts will increase over 2024 but not as much as in the previous year. Take these 2025 numbers into account as you implement 2024 year-end tax planning strategies.

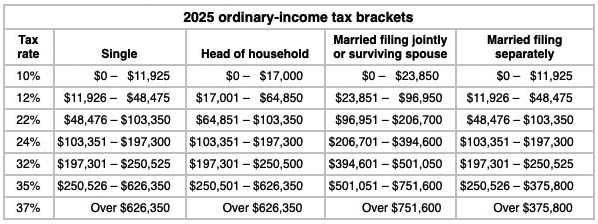

Individual income tax rates

Tax-bracket thresholds increase for each filing status, but because they’re based on percentages, they increase more significantly for the higher brackets. For example, the top of the 10% bracket will increase by $325–$650, depending on filing status, but the top of the 35% bracket will increase by $10,200–$20,400, again depending on filing status.

Note that under the TCJA, the rates and brackets are scheduled to return to their pre-TCJA levels (adjusted for inflation) in 2026 if Congress doesn’t extend the current levels or make other changes.

Standard deduction

The TCJA nearly doubled the standard deduction, indexed annually for inflation, through 2025. In 2025, the standard deduction will be $30,000 for married couples filing jointly, $22,500 for heads of households, and $15,000 for singles and married couples filing separately.

After 2025, the standard deduction amounts are scheduled to drop back to the amounts under pre-TCJA law unless Congress extends the current rules or revises them. Also worth noting is that the personal exemption that was suspended by the TCJA is scheduled to return in 2026. Of course, Congress could extend the suspension.

Long-term capital gains rate

The long-term gains rate applies to realized gains on investments held for more than 12 months. For most types of assets, the rate is 0%, 15% or 20%, depending on your income. While the 0% rate applies to most income that would be taxed at 12% or less based on the taxpayer’s ordinary-income rate, the top long-term gains rate of 20% kicks in before the top ordinary-income rate does.

As with ordinary income tax rates and brackets, those for long-term capital gains are scheduled to return to their pre-TCJA levels (adjusted for inflation) in 2026 if Congress doesn’t extend the current levels or make other changes.

AMT

The alternative minimum tax (AMT) is a separate tax system that limits some deductions, doesn’t permit others and treats certain income items differently. If your AMT liability exceeds your regular tax liability, you must pay the AMT.

Like the regular tax brackets, the AMT brackets are annually indexed for inflation. In 2025, the threshold for the 28% bracket will increase by $6,500 for all filing statuses except married filing separately, which will increase by half that amount.

The AMT exemptions and exemption phaseouts are also indexed. The exemption amounts in 2025 will be $88,100 for singles and $137,000 for joint filers, increasing by $2,400 and $3,700, respectively, over 2024 amounts. The inflation-adjusted phaseout ranges in 2025 will be $626,350–$978,750 for singles and $1,252,700–$1,800,700 for joint filers. Phaseout ranges for married couples filing separately are half of those for joint filers.

The exemptions and phaseouts were significantly increased under the TJCA. Without Congressional action, they’ll drop to their pre-TCJA levels (adjusted for inflation) in 2026.

Education and child-related breaks

The maximum benefits of certain education and child-related breaks will generally remain the same in 2025. But most of these breaks are limited based on a taxpayer’s modified adjusted gross income (MAGI). Taxpayers whose MAGIs are within an applicable phaseout range are eligible for a partial break — and breaks are eliminated for those whose MAGIs exceed the top of the range.

The MAGI phaseout ranges will generally remain the same or increase modestly in 2025, depending on the break. For example:

The American Opportunity credit. For tax years beginning after December 31, 2020, the MAGI amount used by joint filers to determine the reduction in the American Opportunity credit isn’t adjusted for inflation. The credit is phased out for taxpayers with MAGIs in excess of $80,000 ($160,000 for joint returns). The maximum credit per eligible student is $2,500.

The Lifetime Learning credit. For tax years beginning after December 31, 2020, the MAGI amount used by joint filers to determine the reduction in the Lifetime Learning credit isn’t adjusted for inflation. The credit is phased out for taxpayers with MAGIs in excess of $80,000 ($160,000 for joint returns). The maximum credit is $2,000 per tax return.

The adoption credit. The MAGI phaseout range for eligible taxpayers adopting a child will increase in 2025 — by $7,040. It will be $259,190–$299,190 for joint, head-of-household and single filers. The maximum credit will increase by $470, to $17,280 in 2025.

Note: Married couples filing separately generally aren’t eligible for these credits.

These are only some of the education and child-related tax breaks that may benefit you. Keep in mind that, if your MAGI is too high for you to qualify for a break for your child’s education, your child might be eligible to claim one on his or her tax return.

Gift and estate taxes

The unified gift and estate tax exemption and the generation-skipping transfer (GST) tax exemption are both adjusted annually for inflation. In 2025, the amount will be $13.99 million (up from $13.61 million in 2024). Beware that the TJCA approximately doubled these exemptions starting in 2018. Both exemptions are scheduled to drop significantly in 2026 if lawmakers don’t extend the higher amount or make other changes.

The annual gift tax exclusion will increase by $1,000, to $19,000 in 2025. (It isn’t part of a TCJA provision that’s scheduled to expire.)

Crunching the numbers

With the 2025 inflation adjustment amounts trending slightly higher than 2024 amounts, it’s important to understand how they might affect your tax and financial situation. Also keep in mind that many amounts could change substantially in 2026 because of expiring TCJA provisions — or new tax legislation, which could even go into effect sooner. We’d be happy to help crunch the numbers and explain the tax-saving strategies that may make the most sense for you in the current environment of tax law uncertainty.

© 2024